题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Based on Unit 1 Text B: The author thinks that learning English is like taking Chines

答案

答案

请输入或粘贴题目内容

搜题

请输入或粘贴题目内容

搜题

拍照、语音搜题,请扫码下载APP

拍照、语音搜题,请扫码下载APP

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

答案

答案

更多“Based on Unit 1 Text B: The author thinks that learning English is like taking Chines”相关的问题

更多“Based on Unit 1 Text B: The author thinks that learning English is like taking Chines”相关的问题

第1题

Which of the following statements is true?

A.The target cost will decrease and the cost gap will increase

B.The target cost will increase and the cost gap will decrease

C.The target cost will remain the same and the cost gap will increase

D.The target cost will remain the same and the cost gap will decrease

第2题

Section A – BOTH questions are compulsory and MUST be attempted

Tramont Co is a listed company based in the USA and manufactures electronic devices. One of its devices, the X-IT, is produced exclusively for the American market. Tramont Co is considering ceasing the production of the X-IT gradually over a period of four years because it needs the manufacturing facilities used to make the X-IT for other products.

The government of Gamala, a country based in south-east Asia, is keen to develop its manufacturing industry and has offered Tramont Co first rights to produce the X-IT in Gamala and sell it to the USA market for a period of four years. At the end of the four-year period, the full production rights will be sold to a government-backed company for Gamalan Rupiahs (GR) 450 million after tax (this amount is not subject to inflationary increases). Tramont Co has to decide whether to continue production of the X-IT in the USA for the next four years or to move the production to Gamala immediately.

Currently each X-IT unit sold makes a unit contribution of $20. This unit contribution is not expected to be subject to any inflationary increase in the next four years. Next year’s production and sales estimated at 40,000 units will fall by 20% each year for the following three years. It is anticipated that after four years the production of the X-IT will stop. It is expected that the financial impact of the gradual closure over the four years will be cost neutral (the revenue from sale of assets will equal the closure costs). If production is stopped immediately, the excess assets would be sold for $2·3 million and the costs of closure, including redundancy costs of excess labour, would be $1·7 million.

The following information relates to the production of the X-IT moving to Gamala. The Gamalan project will require an initial investment of GR 230 million, to pay for the cost of land and buildings (GR 150 million) and machinery (GR 80 million). The cost of machinery is tax allowable and will be depreciated on a straight-line basis over the next four years, at the end of which it will have a negligible value.

Tramont Co will also need GR 40 million for working capital immediately. It is expected that the working capital requirement will increase in line with the annual inflation rate in Gamala. When the project is sold, the working capital will not form. part of the sale price and will be released back to Tramont Co.

Production and sales of the device are expected to be 12,000 units in the first year, rising to 22,000 units, 47,000 units and 60,000 units in the next three years respectively.

The following revenues and costs apply to the first year of operation: – Each unit will be sold for $70;

– The variable cost per unit comprising of locally sourced materials and labour will be GR 1,350, and;

– In addition to the variable cost above, each unit will require a component bought from Tramont Co for $7, on which Tramont Co makes $4 contribution per unit;

– Total fixed costs for the first year will be GR 30 million.

The costs are expected to increase by their countries’ respective rates of inflation, but the selling price will remain fixed at $70 per unit for the four-year period.

The annual corporation tax rate in Gamala is 20% and Tramont Co currently pays corporation tax at a rate of 30% per year. Both countries’ corporation taxes are payable in the year that the tax liability arises. A bi-lateral tax treaty exists between the USA and Gamala, which permits offset of overseas tax against any USA tax liability on overseas earnings. The USA and Gamalan tax authorities allow losses to be carried forward and written off against future profits for taxation purposes.

Tramont Co has decided to finance the project by borrowing the funds required in Gamala. The commercial borrowing rate is 13% but the Gamalan government has offered Tramont Co a 6% subsidised loan for the entire amount of the initial funds required. The Gamalan government has agreed that it will not ask for the loan to be repaid as long as Tramont Co fulfils its contract to undertake the project for the four years. Tramont Co can borrow dollar funds at an interest rate of 5%.

Tramont Co’s financing consists of 25 million shares currently trading at $2·40 each and $40 million 7% bonds trading at $1,428 per $1,000. Tramont Co’s quoted beta is 1·17. The current risk free rate of return is estimated at 3% and the market risk premium is 6%. Due to the nature of the project, it is estimated that the beta applicable to the project if it is all-equity financed will be 0·4 more than the current all-equity financed beta of Tramont Co. If the Gamalan project is undertaken, the cost of capital applicable to the cash flows in the USA is expected to be 7%.

The spot exchange rate between the dollar and the Gamalan Rupiah is GR 55 per $1. The annual inflation rates are currently 3% in the USA and 9% in Gamala. It can be assumed that these inflation rates will not change for the foreseeable future. All net cash flows arising from the project will be remitted back to Tramont Co at the end of each year.

There are two main political parties in Gamala: the Gamala Liberal (GL) Party and the Gamala Republican (GR) Party. Gamala is currently governed by the GL Party but general elections are due to be held soon. If the GR Party wins the election, it promises to increase taxes of international companies operating in Gamala and review any commercial benefits given to these businesses by the previous government.

Required:

Prepare a report for the Board of Directors of Tramont Co that

(i) Evaluates whether or not Tramont Co should undertake the project to produce the X-IT in Gamala and cease its production in the USA immediately. In the evaluation, include all relevant calculations in the form. of a financial assessment and explain any assumptions made;

Note: it is suggested that the financial assessment should be based on present value of the operating cash flows from the Gamalan project, discounted by an appropriate all-equity rate, and adjusted by the present value of all other relevant cash flows. (27 marks)

(ii) Discusses the potential change in government and other business factors that Tramont Co should consider before making a final decision. (8 marks)

Professional marks will be awarded in question 1 for the format, structure and presentation of the answer. (4 marks)

第3题

Chair Co plans on pricing the seat by adding a 50% mark-up to the total variable cost per seat, with the labour cost being based on the incremental time taken to produce the 8th unit.

Required:

(a) Calculate the price which Chair Co expects to charge for the new seat. Note: The learning index for a 75% learning curve is –0·415. (5 marks)

(b) The first phase of production has now been completed for the new car seat. The first unit actually took 12·5 hours to make and the total time for the first eight units was 34·3 hours, at which point the learning effect came to an end. Chair Co are planning on adjusting the price to reflect the actual time it took to complete the 8th unit.

Required:

(i) Calculate the actual rate of learning and state whether this means that the labour force actually learnt more quickly or less quickly than expected. (3 marks)

(ii) Briefly explain whether the adjusted price charged by Chair Co will be higher or lower than the price you calculated in part (a) above. You are NOT required to calculate the adjusted price. (2 marks)

第4题

第5题

1 The scientists in the research laboratories of Swan Hill Company (SHC, a public listed company) recently made a very

important discovery about the process that manufactured its major product. The scientific director, Dr Sonja Rainbow,

informed the board that the breakthrough was called the ‘sink method’. She explained that the sink method would

enable SHC to produce its major product at a lower unit cost and in much higher volumes than the current process.

It would also produce lower unit environmental emissions and would substantially improve product quality compared

to its current process and indeed compared to all of the other competitors in the industry.

SHC currently has 30% of the global market with its nearest competitor having 25% and the other twelve producers

sharing the remainder. The company, based in the town of Swan Hill, has a paternalistic management approach and

has always valued its relationship with the local community. Its website says that SHC has always sought to maximise

the benefit to the workforce and community in all of its business decisions and feels a great sense of loyalty to the

Swan Hill locality which is where it started in 1900 and has been based ever since.

As the board considered the implications of the discovery of the sink method, chief executive Nelson Cobar asked

whether Sonja Rainbow was certain that SHC was the only company in the industry that had made the discovery and

she said that she was. She also said that she was certain that the competitors were ‘some years’ behind SHC in their

research.

It quickly became clear that the discovery of the sink method was so important and far reaching that it had the

potential to give SHC an unassailable competitive advantage in its industry. Chief executive Nelson Cobar told board

colleagues that they should clearly understand that the discovery had the potential to put all of SHC’s competitors out

of business and make SHC the single global supplier. He said that as the board considered the options, members

should bear in mind the seriousness of the implications upon the rest of the industry.

Mr Cobar said there were two strategic options. Option one was to press ahead with the huge investment of new plant

necessary to introduce the sink method into the factory whilst, as far as possible, keeping the nature of the sink

technology secret from competitors (the ‘secrecy option’). A patent disclosing the nature of the technology would not

be filed so as to keep the technology secret within SHC. Option two was to file a patent and then offer the use of the

discovery to competitors under a licensing arrangement where SHC would receive substantial royalties for the twentyyear

legal lifetime of the patent (the ‘licensing option’). This would also involve new investment but at a slower pace

in line with competitors. The licence contract would, Mr Cobar explained, include an ‘improvement sharing’

requirement where licensees would be required to inform. SHC of any improvements discovered that made the sink

method more efficient or effective.

The sales director, Edwin Kiama, argued strongly in favour of the secrecy option. He said that the board owed it to

SHC’s shareholders to take the option that would maximise shareholder value. He argued that business strategy was

all about gaining competitive advantage and this was a chance to do exactly that. Accordingly, he argued, the sink

method should not be licensed to competitors and should be pursued as fast as possible. The operations director said

that to gain the full benefits of the sink method with either option would require a complete refitting of the factory and

the largest capital investment that SHC had ever undertaken.

The financial director, Sean Nyngan, advised the board that pressing ahead with investment under the secrecy option

was not without risks. First, he said, he would have to finance the investment, probably initially through debt, and

second, there were risks associated with any large investment. He also informed the board that the licensing option

would, over many years, involve the inflow of ‘massive’ funds in royalty payments from competitors using the SHC’s

patented sink method. By pursuing the licensing option, Sean Nyngan said that they could retain their market

leadership in the short term without incurring risk, whilst increasing their industry dominance in the future through

careful investment of the royalty payments.

The non-executive chairman, Alison Manilla, said that she was looking at the issue from an ethical perspective. She

asked whether SHC had the right, even if it had the ability, to put competitors out of business.

Required:

(a) Assess the secrecy option using Tucker’s model for decision-making. (10 marks)

第6题

(b) (i) Advise Alasdair of the tax implications and relative financial risks attached to the following property

investments:

(1) buy to let residential property;

(2) commercial property; and

(3) shares in a property investment company/unit trust. (9 marks)

第8题

B.Base unit of measure in the material master from EA (each) to KG (kilogram)

C.Material type from ROH (raw material) to FERT (finished product)

D.Material group in the material master from material group 1 to material group 2

第9题

(1) Calculate the target cost

(2) Calculate the estimated current cost based on the existing product specification

(3) Set the required profit

(4) Set the selling price

(5) Calculate the target cost gap

Which of the following represents the correct sequence if target costing were to be used?

A.(1), (2), (3), (4), (5)

B.(2), (3), (4), (1), (5)

C.(4), (3), (1), (2), (5)

D.(4), (5), (3), (1), (2)

第10题

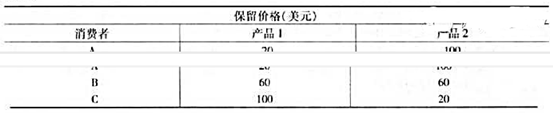

你在一个有三个消费者组成的市场上销售产品1和产品2。三个消费者的保留价格如下:

各产品的单位成本为30美元。

(1)对分开销售两种产品、纯捆绑销售和混合捆绑销售,分别计算价格和利润。

(2)哪种策略是最有利可图的?为什么?

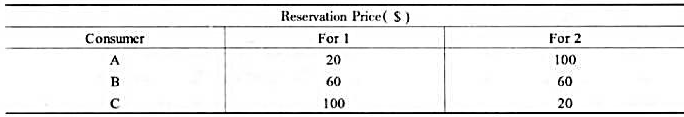

You are selling two gods, I and 2, to a market consisting of three consumers with reservation prices as follows :

The unit cost of each product is $ 20.

a. Compute the optimal prices and profits for (i) selling the goods separately, (ii) pure bundling, and (iii) mixed bundling.

b. Which strategy is most profitable? Why?

第11题

VI. Writing (25 points)

Directions: For this part, you are supposed to write a letter of refasal in English in 100-120 words based on the following situation. Remember to write it clearly.

61. 你(Li Yuan)的朋友(Jack)邀请你暑期到他家乡—农村去度假。写封信委婉拒绝。信的内容如下:

(1) 对邀请表示感谢;

(2) 不能如愿的原因;

(3) 提出弥补的方式。