题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

S:Two yuan. P:That’s all right. 4

S:Two yuan.

P:That’s all right. 4

答案

答案

请输入或粘贴题目内容

搜题

请输入或粘贴题目内容

搜题

拍照、语音搜题,请扫码下载APP

拍照、语音搜题,请扫码下载APP

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

S:Two yuan.

P:That’s all right. 4

答案

答案

更多“S:Two yuan. P:That’s all right. 4”相关的问题

更多“S:Two yuan. P:That’s all right. 4”相关的问题

第1题

根据以下材料回答第 1~5 题:

A.I will take it.

B.How much is it?

C.What can I do for you?

D.Which one do you like?

E.Let me help you.

F.How many ones do you want?

G.Here you are.

H.Thank you SO much!

(S=Shopkeeper。P=Peter)

第 55 题

S: 1

P:1 wan to buy a notebook.

S:The notebooks are over there. 2

P:The blue one looks nice. 3

S:Two yuan.

P:That’s all right. 4

S: 5

P:Thank you.

第2题

A: Will that be OK?

B: How much are the tickets?

C: Two second-class is fine, thank you.

D: May I help you?

E: Have a nice trip

W: Good morning. 26____________

M: Hi, we&39;d like two tickets to Fuzhou, please.

W: Fuzhou. Certainly. Travelling today?

M: Yes. W: The next train is at 12: 00. 27___________

M: I’ll take the 12: 00 tickets.

W: Single or return?

M: Two singles. 28___________

W:First-class is 100 yuan and second-class is 80 yuan.

M: 29___________

W: that&39;s 160 yuan, please.

M: Here’s the money

W: And here are your tickets. 30___________

26、__________

27_________

28_________

29_________

30_________

请帮忙给出每个问题的正确答案和分析,谢谢!

第3题

It can be inferred from the conversation that

A. the two speakers are the student and the professor.

B. the development of large cities in the developing countries is not balanced.

C. the large cities in the developing countries grew as rapidly as those in the developed countries.

D. it's easy to solve the problems of the large cities.

第4题

A.wide

B.international

C.foreign

D.narrow

第5题

Section B – TWO questions ONLY to be attempted

Perkin manufactures electronic components for export worldwide, from factories in Ceeland, for use in smartphones and hand held gaming devices. These two markets are supplied with similar components by two divisions, Phones Division (P) and Gaming Division (G). Each division has its own selling, purchasing, IT and research and development functions, but separate IT systems. Some manufacturing facilities, however, are shared between the two divisions.

Perkin’s corporate objective is to maximise shareholder wealth through innovation and continuous technological improvement in its products. The manufacturers of smartphones and gaming devices, who use Perkin’s components, update their products frequently and constantly compete with each other to launch models which are technically superior.

Perkin has a well-established incremental budgeting process. Divisional managers forecast sales volumes and costs months in advance of the budget year. These divisional budgets are then scrutinised by the main board, and revised significantly by them in line with targets they have set for the business. The finalised budgets are often approved after the start of the accounting year. Under pressure to deliver consistent returns to institutional shareholders, the board does not tolerate failure by either division to achieve the planned net profit for the year once the budget is approved. Last year’s results were poor compared to the annual budget. Divisional managers, who are appraised on the financial performance of their own division, have complained about the length of time that the budgeting process takes and that the performance of their divisions could have been better but was constrained by the budgets which were set for them.

In P Division, managers had failed to anticipate the high popularity of a new smartphone model incorporating a large screen designed for playing games, and had not made the necessary technical modifications to the division’s own components. This was due to the high costs of doing so, which had not been budgeted for. Based on the original sales forecast, P Division had already committed to manufacturing large quantities of the existing version of the component and so had to heavily discount these in order to achieve the planned sales volumes.

A critical material in the manufacture of Perkin’s products is silver, which is a commodity which changes materially in price according to worldwide supply and demand. During the year supplies of silver were reduced significantly for a short period of time and G Division paid high prices to ensure continued supply. Managers of G Division were unaware that P Division held large inventories of silver which they had purchased when the price was much lower.

Initially, G Division accurately forecasted demand for its components based on the previous years’ sales volumes plus the historic annual growth rate of 5%. However, overall sales volumes were much lower than budgeted. This was due to a fire at the factory of their main customer, which was then closed for part of the year. Reacting to this news, managers at G Division took action to reduce costs, including closing one of the three R&D facilities in the division.

However, when the customer’s factory reopened, G Division was unwilling to recruit extra staff to cope with increased demand; nor would P Division re-allocate shared manufacturing facilities to them, in case demand increased for its own products later in the year. As a result, Perkin lost the prestigious preferred supplier status from their main customer who was unhappy with G Division’s failure to effectively respond to the additional demand. The customer had been forced to purchase a more expensive, though technically superior, component from an alternative manufacturer.

The institutional shareholders’ representative, recently appointed to the board, has asked you as a performance management expert for your advice. ‘We need to know whether Perkin’s budgeting process is appropriate for the business, and how this contributed to last year’s poor performance’, she said, ‘and more importantly, how do we need to change the process to prevent this happening in the future, such as a move to beyond budgeting.’

Required:

(a) Evaluate the weaknesses in Perkin’s current budgeting system and whether it is suitable for the environment in which Perkin operates. (13 marks)

(b) Evaluate the impact on Perkin of moving to beyond budgeting. (12 marks)

第6题

Section B – TWO questions ONLY to be attempted

Louieed Co

Louieed Co, a listed company, is a major supplier of educational material, selling its products in many countries. It supplies schools and colleges and also produces learning material for business and professional exams. Louieed Co has exclusive contracts to produce material for some examining bodies. Louieed Co has a well-defined management structure with formal processes for making major decisions.

Although Louieed Co produces online learning material, most of its profits are still derived from sales of traditional textbooks. Louieed Co’s growth in profits over the last few years has been slow and its directors are currently reviewing its long-term strategy. One area in which they feel that Louieed Co must become much more involved is the production of online testing materials for exams and to validate course and textbook learning.

Bid for Tidded Co

Louieed Co has recently made a bid for Tidded Co, a smaller listed company. Tidded Co also supplies a range of educational material, but has been one of the leaders in the development of online testing and has shown strong profit growth over recent years. All of Tidded Co’s initial five founders remain on its board and still hold 45% of its issued share capital between them. From the start, Tidded Co’s directors have been used to making quick decisions in their areas of responsibility. Although listing has imposed some formalities, Tidded Co has remained focused on acting quickly to gain competitive advantage, with the five founders continuing to give strong leadership.

Louieed Co’s initial bid of five shares in Louieed Co for three shares in Tidded Co was rejected by Tidded Co’s board. There has been further discussion between the two boards since the initial offer was rejected and Louieed Co’s board is now considering a proposal to offer Tidded Co’s shareholders two shares in Louieed Co for one share in Tidded Co or a cash alternative of $22·75 per Tidded Co share. It is expected that Tidded Co&39;s shareholders will choose one of the following options:

(i) To accept the two-shares-for-one-share offer for all the Tidded Co shares; or,

(ii) To accept the cash offer for all the Tidded Co shares; or,

(iii) 60% of the shareholders will take up the two-shares-for-one-share offer and the remaining 40% will take the cash offer.

In case of the third option being accepted, it is thought that three of the company&39;s founders, holding 20% of the share capital in total, will take the cash offer and not join the combined company. The remaining two founders will probably continue to be involved in the business and be members of the combined company&39;s board.

Louieed Co’s finance director has estimated that the merger will produce annual post-tax synergies of $20 million. He expects Louieed Co’s current price-earnings (P/E) ratio to remain unchanged after the acquisition.

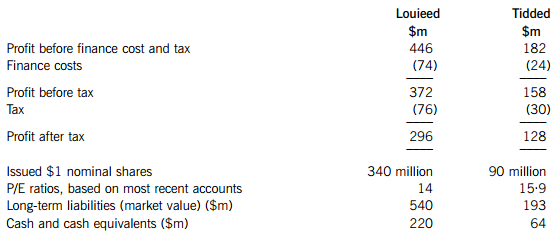

Extracts from the two companies’ most recent accounts are shown below:

The tax rate applicable to both companies is 20%.

Assume that Louieed Co can obtain further debt funding at a pre-tax cost of 7·5% and that the return on cash surpluses is 5% pre-tax.

Assume also that any debt funding needed to complete the acquisition will be reduced instantly by the balances of cash and cash equivalents held by Louieed Co and Tidded Co.

Required:

(a) Discuss the advantages and disadvantages of the acquisition of Tidded Co from the viewpoint of Louieed Co. (6 marks)

(b) Calculate the P/E ratios of Tidded Co implied by the terms of Louieed Co’s initial and proposed offers, for all three of the above options. (5 marks)

(c) Calculate, and comment on, the funding required for the acquisition of Tidded Co and the impact on Louieed Co’s earnings per share and gearing, for each of the three options given above.

Note: Up to 10 marks are available for the calculations. (14 marks)

第7题

Shenhua Company Ltd (Shenhua) has been buying products from Kangyi Chemicals Company (Kangyi Chemicals) for more than one year. By the end of 2013, the two parties negotiated to settle the previous business transactions and confirmed that Shenhua owed an outstanding amount of RMB 800,000 yuan to Kangyi Chemicals.

Several days later, Shenhua entered into an agreement with its holding company, namely Shenhua Holdings, to transfer all its debts of RMB 800,000 yuan due. In doing so, Shenhua neither notified Kangyi Chemicals, nor got a consent from Kangyi Chemicals.

Having discovered this information, Kangyi Chemicals sent an email to Shenhua Holdings to inquire whether Shenhua’s debts had been transferred to Shenhua Holdings. Shenhua Holdings acknowledged the transfer but did not promise to settle the debts as a new debtor.

Kangyi Chemicals filed a lawsuit against Shenhua Holdings for the unsettled RMB 800,000 yuan. Shenhua Holdings submitted the following defences: First, the transfer agreement between Shenhua and Shenhua Holdings was an invalid one as Shenhua failed to get prior consent, as required by the law, from Kangyi Chemicals before the completion of transfer. Second, the goods delivered by Kangyi Chemicals in the last six months contained material defects which caused loss and damage to Shenhua as the original counterparty.

Required:

Answer the following questions in accordance with the Contract Law, and give your reasons for your answers:

(a) state whether the transfer agreement between Shenhua and Shenhua Holdings was a valid one; (6 marks)

(b) state whether Shenhua Holdings was entitled to submit its defence on the ground of the defects in the goods delivered by Kangyi Chemicals to Shenhua. (4 marks)

第8题

He is quite sure that it's ______ impossible for him to fulfill the task within two days.

A.absolutely

B.fully

C.exclusively

D.roughly

第10题

Buyer made the advance payment, but Seller did not deliver any goods. Buyer urged Seller to deliver the goods immediately, as its production would be seriously affected by the short supply of the goods. However, Seller declared force majeure as the reason for non-delivery. Seller insisted that it was only a trading company, not a producer of the chemical products. Seller alleged that upon the conclusion of the contract, it entered into a purchase agreement with a producer to buy the goods from the latter. Due to a fire accident, the producer could not supply the goods under the purchase agreement; Seller therefore could not deliver the goods to Buyer. Non-delivery of goods was due to force majeure that caused the failure to supply the goods by the producer to Seller.

Buyer refused to accept Seller’s argument and bought 10,000 kg of the same products for replacement at a price of RMB 220 yuan/kg, resulting in a total extra cost of RMB 200,000 yuan. Meanwhile it filed a lawsuit against Seller in the court, requesting liquidated damages of RMB 400,000 yuan (20% of the total price) and the damages of RMB 200,000 yuan for extra price caused for the urgent purchase.

Required:

Answer the following questions in accordance with the relevant provisions of the Contract Law, and give your reasons for your answer:

(a) state whether Seller’s argument of force majeure can be established; (5 marks)

(b) state whether Buyer’s claims for liquidated damages and damages should be supported by the court. (5 marks)